kentucky sales tax on-farm vehicles

How to Calculate Kentucky Sales Tax on a Car. Of sale or purchase of which shall be exempt from sales and use tax.

Kentucky Solar Farm Invite Is Not Sitting Well With Rural Neighbors

Kentucky Sales Tax Facts Division of Sales and Use Tax Station 53 PO.

. A Dual wheel assemblies. Box 181 Frankfort KY 40602-0181 or call 502 564-5170 Fax 502 564-2041 Web site wwwrevenuekygov Th e. Are churches exempt from the Motor Vehicle Usage Tax.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all. House Bill 8 FAQs Available on TaxAnswerskygov. State Tax Rates.

In Kentucky certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. All agriculture exemption license numbers will expire on. Kentucky has a statewide sales tax rate of 6 which has been in place since 1960.

Kentucky sales tax on-farm vehicles Sunday May 8 2022 Edit. Sales Tax Exemptions in Kentucky. 16 2022 To help Kentuckians combat rising prices due to inflation brought on by the global.

Photos of this event can be found here. Exempt from weight distance tax in Kentucky KYU. Printable Kentucky Farm Certificate of Exemption Form 51A158 for making sales tax free purchases in Kentucky.

Yes every transfer of title or registration is subject to Motor Vehicle Usage Tax. 2022 Kentucky legislation in House Bill 8 makes substantial c hanges to how various services are. The state of Kentucky imposes a 6 sales tax rate on all car sales and there are no additional sales taxes imposed by individual cities or counties.

Several exceptions to this tax are most types of farming. For Kentucky it will always be at 6. Labor and services associated with the repair installation and maintenance of taxable tangible personal property.

Effective July 1 2018 sales and use tax is also imposed on. Changes effective January 1 2023. 650 Definitions for KRS 186650 to.

What Transactions Are Subject To The Sales Tax In Kentucky Kentucky Vehicle Sales Tax Fees. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. SALES AND USE TAX The sales and use tax was first levied in its current form in 1960.

Several exceptions to the state sales tax are. The deadline for farmers to obtain their agriculture exemption license number has been extended until January 1 2023. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another.

For example an item that costs 100 will have a tax of 6 for a total of 106 100 times 06 equals. In the state of Kentucky legally sales tax is required to be collected from tangible physical products being sold to a consumer. Printable PDF Kentucky Sales Tax Datasheet.

Unlike sales tax there is no provision in KRS. Municipal governments in Kentucky. To calculate Kentuckys sales and use tax multiply the purchase price by 6 percent 006.

It is levied at six percent and shall be paid on every motor vehicle. KY Sales Tax Calculator. Motor Vehicle Usage Tax.

2 Repair and replacement.

Ag Prepares For Electric Powered Future

Sales Tax Laws By State Ultimate Guide For Business Owners

How This Farmer S Amazon Career Helps Him Feed His Community

Kentucky Sales Tax Small Business Guide Truic

Free Farm Tractor Bill Of Sale Form Pdf Word Eforms

Form 51a158 Fillable Farm Exemption Certificate

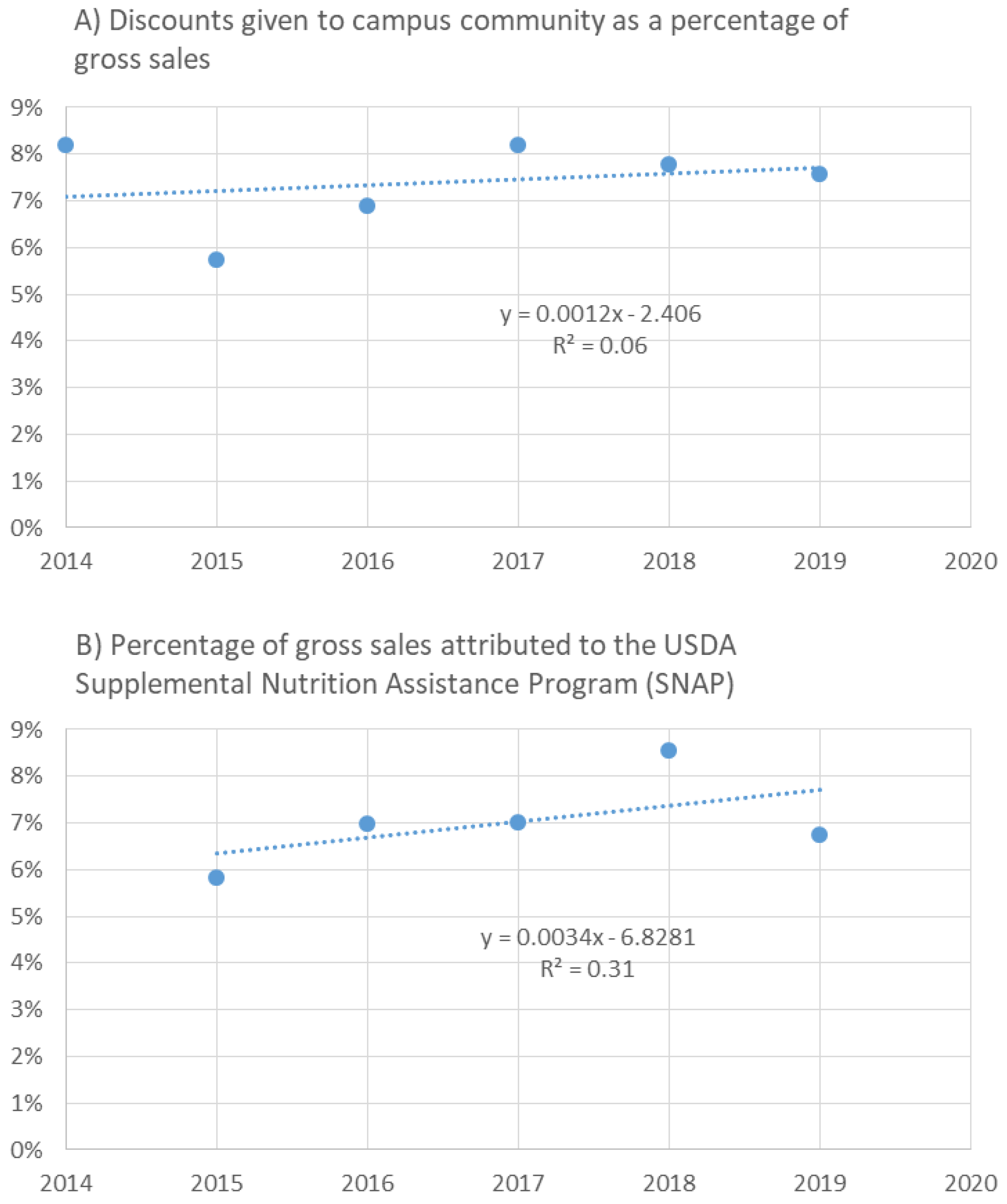

Sustainability Free Full Text Financial Viability Of An On Farm Processing And Retail Enterprise A Case Study Of Value Added Agriculture In Rural Kentucky Usa Html

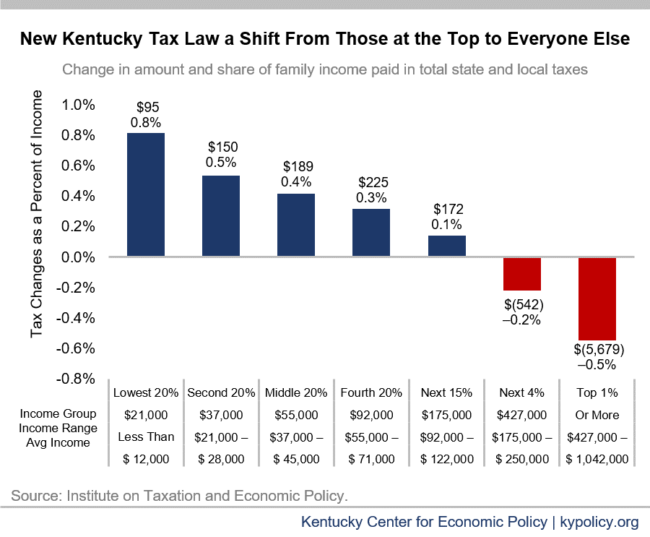

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Solar Farm Invite Is Not Sitting Well With Rural Neighbors

51a158 Form Fill Out Sign Online Dochub

![]()

Agriculture Gps Fleet Tracking Verizon Connect

Bourbon Barrel Tax Credit Fuels Kentucky Warehouse Growth Lexington Herald Leader

Ford Brothers Fall Farm Machinery Vehicles Equipment Recreational Vehicle Online Consignment Auction

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

Northern Kentucky Equipment Verona Ky

Kentucky Sales Tax Calculator And Local Rates 2021 Wise

Ag Prepares For Electric Powered Future

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics